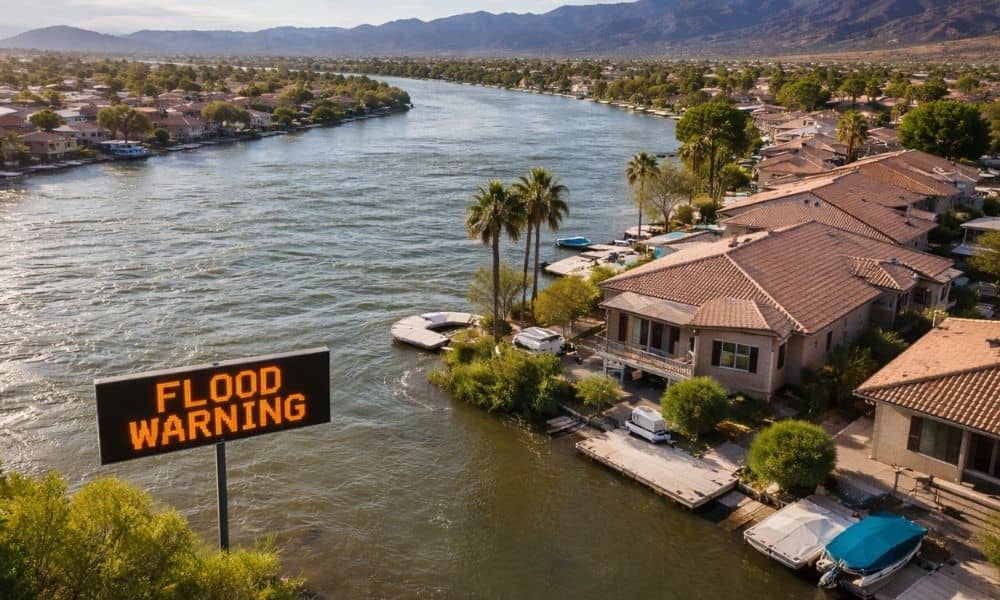

When flood warnings hit the Colorado River this month, most people in Laughlin looked toward the shoreline. However, the real impact didn’t start with water in the streets. Instead, it started with phone calls, emails, and letters from lenders and insurance companies. Suddenly, many homeowners heard the same question: “Do you have a current elevation certificate?”

Even if your yard stayed dry, those recent flood advisories triggered something bigger. In Laughlin, where homes sit close to the Colorado River, rising water levels can affect how banks and insurers review properties. As a result, more residents are rushing to secure updated elevation data before paperwork turns urgent.

Flood Warnings Do More Than Raise Water Levels

At first glance, a river flood warning sounds like a simple safety alert. Yet in areas like Laughlin, it also sets off behind-the-scenes reviews. Insurance carriers recheck flood zones. Mortgage lenders verify risk classifications. Title companies double-check records during closings.

Because of this, even homeowners who have never flooded may receive requests for updated documentation.

That is where an elevation certificate becomes important.

An elevation certificate shows how high your home sits compared to the Base Flood Elevation set by FEMA. In simple terms, it proves whether your house stands above or below the official flood level for your area.

After a regional flood alert, lenders often want updated proof.

Why Laughlin Is Different From Other Nevada Cities

Unlike Las Vegas or Henderson, Laughlin sits right along the Colorado River. Therefore, flood risk does not only come from heavy rain. It can also come from river-level changes, dam releases, or upstream runoff.

When water levels shift at Lake Mead or Hoover Dam, downstream areas like Laughlin feel the effect. Even small increases in river flow can change how flood risk models apply to nearby properties.

Because of that, FEMA flood maps around river communities carry more weight. As soon as warnings appear, lenders pay closer attention to homes within mapped flood zones.

So while your neighborhood may look calm, your property file may be under review.

When Banks Request an Elevation Certificate

Many homeowners feel surprised when a bank asks for new elevation data. However, certain situations automatically trigger a review.

For example:

- Refinancing your mortgage

- Selling your home

- Buying a property near the river

- Switching insurance carriers

- Renewing a flood insurance policy

- Transferring your loan to a new servicer

During these steps, lenders run flood-zone checks. If your property falls inside or near a Special Flood Hazard Area, they may request a current elevation certificate before moving forward.

Without it, closing can stall.

Therefore, homeowners who plan to refinance or sell soon often secure updated documentation ahead of time.

Flood Map Updates Can Change Everything

Another reason residents rush to act involves FEMA map updates. Flood maps do not stay the same forever. Engineers revise them based on new data, river patterns, and modeling studies.

As a result, some properties shift into higher-risk zones even if nothing physically changes on the lot.

If that happens, insurance requirements can change overnight. However, an elevation certificate may show that your home actually sits above the required flood line. In some cases, that data supports a formal request to correct the map classification.

Without official elevation proof, homeowners often accept higher premiums without question.

With it, they have options.

Why Demand Spikes After River Alerts

After recent Colorado River flood warnings, surveyors across the region saw a jump in calls. This pattern makes sense.

First, flood alerts raise awareness. Second, lenders tighten review standards during active advisories. Third, real estate professionals warn clients to prepare documentation early.

Because everyone moves at once, appointment schedules fill quickly.

If you wait until a refinance deadline approaches, you may struggle to secure fast service. Therefore, proactive homeowners book their elevation certificate before paperwork becomes urgent.

Planning ahead prevents stress later.

What Makes an Elevation Certificate “Current”?

Some residents already have a certificate from years ago. However, older reports may not satisfy today’s lenders.

Several factors can make an older document outdated:

- FEMA flood map revisions

- Property improvements or additions

- Yard grading or fill changes

- Updated federal flood modeling standards

Even if your home has not changed, updated flood maps alone may require fresh measurements.

In most cases, lenders prefer documentation completed within the last five to ten years. If your report predates recent map updates, an updated elevation certificate helps avoid delays.

How the Process Works

The process remains straightforward.

A licensed land surveyor visits your property and measures key elevation points. The survey ties those measurements to official county benchmarks. Then the surveyor completes FEMA’s required form using verified data.

Because river communities demand precision, surveyors use professional-grade GPS equipment or total station instruments to ensure accuracy.

Once complete, you receive a certified report. You can then submit it to your lender, insurance provider, or real estate agent.

Most residential surveys take a short amount of time, yet the documentation can support your property file for years.

When Should You Act?

You should consider ordering an elevation certificate if:

- You live near the Colorado River corridor

- You received a flood determination notice

- You plan to refinance or sell

- You never had one completed

- Your previous report is more than a decade old

Even if floodwater never reaches your yard, documentation matters. Flood risk classification affects mortgages and insurance policies long before physical damage occurs.

Therefore, many homeowners act now instead of reacting later.

A Calm Step That Prevents Bigger Problems

Flood warnings often create anxiety. However, preparation brings control.

An elevation certificate does not mean your home faces danger. Instead, it provides clear data about where your property stands relative to official flood levels. That data helps lenders make decisions, insurers set rates, and buyers move forward with confidence.

In a riverfront town like Laughlin, water levels can change quickly. Administrative reviews can move just as fast.

By securing updated elevation information now, you avoid rushed deadlines, delayed closings, and last-minute surprises. More importantly, you gain clarity about your property’s position in today’s flood landscape.

And in times of rising water, clarity matters.